9 Reasons You Should File the FAFSA Before Being Accepted

We strongly recommend submitting the FAFSA as early as December of your student’s senior year of high school, whether they have been accepted to a college or not. We share 8 reasons to complete the FAFSA early, along with a list of what you need to complete it and the types of financial aid available to you.

Should you apply for FAFSA before being accepted?

The short answer to this question is YES.

In fact, you can complete the FAFSA before you even submit a college application!

Just mentioning the FAFSA to most parents is enough to send them into a tailspin. I’ve worked with thousands of families in admissions and I know the FAFSA looms over the whole application process.

Yes, it seems like a lengthy process that’s overly complicated.

That’s why we’re here. To get you from start to finish, one step at a time.

How Does The FAFSA Work?

The FAFSA, or the Free Application for Federal Student Aid, is a financial aid application. The government uses the FAFSA to determine how much federal aid a student qualifies for, based on their individual financial situation.

After you submit your FAFSA (do it early!) you’ll get a notification that your Student Aid Report (SAR) is ready to view. The SAR is a summary of the information you put on your FAFSA.

The SAR also includes your Estimated Family Contribution (EFC) and estimated information about federal loans and grant eligibility.

After you apply to a college or university, you’ll receive a financial aid award letter.

If that quick overview feels like a jumble of alphabet soup, know that you’re not alone. The rest of this post will clear up the confusion!

Why Should I Complete the FAFSA Early?

It’s a smart financial move. Before we get into some of the specifics, let’s take a big picture view of why it’s a good idea to complete the FAFSA early.

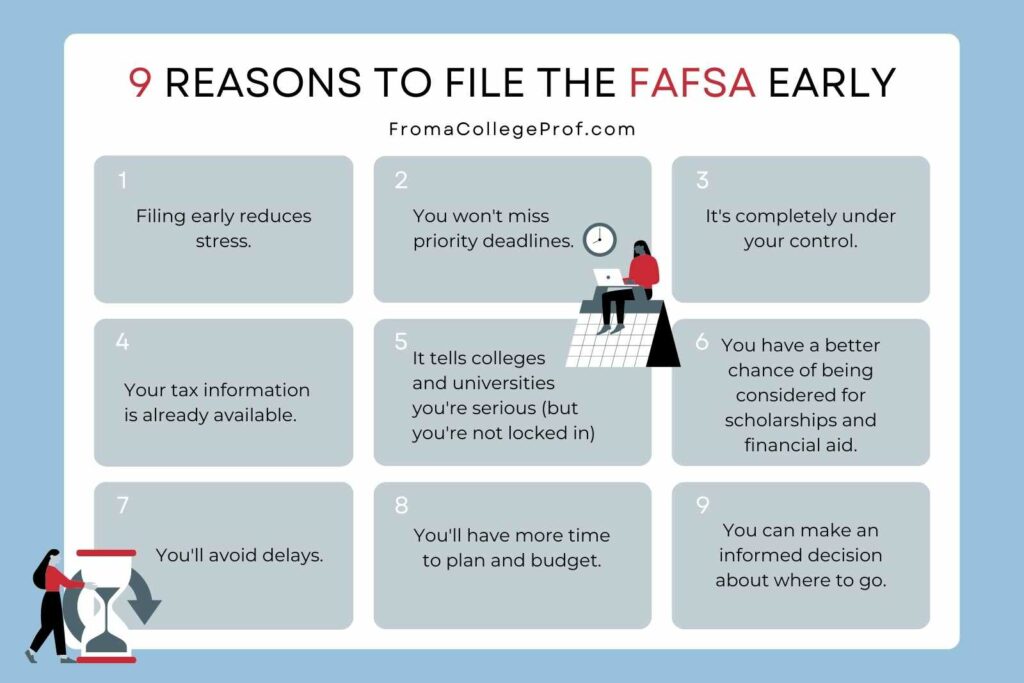

- It reduces stress. Your teen’s senior year already feels like a giant to-do list, doesn’t it? Cross the FAFSA off that list as early as December and give your family some space to enjoy the rest of the school year.

- You won’t miss priority deadlines. The college admissions process comes with a lot of deadlines and it’s not easy to keep track of all of them. Submitting the FAFSA as soon as it’s available eliminates one set of deadlines so you can focus on other things.

- It’s completely under your control. You don’t have to wait for your teen to finish applications, ask for recommendations, write essays…this is something you can do on your own.

- Your tax information is already available. The 2024-2025 FAFSA relies on your 2022 federal tax returns, NOT your 2023 returns. There’s no reason to wait for the 2023 return if you haven’t completed it yet.

- It tells colleges and universities you’re serious (but you’re not locked in). Completing the FAFSA early sends a clear message that you’re seriously interested in applying and attending school next year.

You can choose up to 10 institutions to receive your information. You’re not making a commitment to any of those schools. And you can always add other schools later in the financial aid process. - You have a better chance of being considered for scholarships and financial aid. Colleges and universities won’t have to wait for the FAFSA form after you’ve been admitted, so they can put together an aid package for you.

- You’ll avoid delays. If you wait until after your acceptance letter arrives to submit the FAFSA, you may experience delays in receiving your aid package. That delay can lead to unnecessary stress as you wait.

- You’ll have more time to plan and budget. After you’re admitted and you receive the financial aid package, you’ll have concrete financial information about tuition, fees, room and board.

- You can make an informed decision. It’s much easier to evaluate your college options when you’re looking at real numbers. You may eliminate some schools if they’re simply not affordable, and you may be pleasantly surprised by schools that are still in play for your family.

When Are The FAFSA Deadlines?

There are 3 FAFSA deadlines to put on your calendar: college, state and federal. (We know…why does this have to be so confusing? Hang in there. We’re here to help you navigate it.)

The FAFSA “opens” on December 31st for the 2024-2025 year, and the sooner you fill it out, the better. If you set your own deadline to get it done early, you won’t miss important dates.

Priority deadlines are likely to come from the college or university as well as the state. Students who meet these deadlines are given priority consideration for institutional aid and scholarships.

An important note! The more selective an institution is, the more likely they are to have an earlier deadline.

First, look up priority deadlines for each school you’re interested in.

These dates may range from November 1st to March 15th and will be available on the school’s website. Private colleges may have multiple deadlines, some that may be specifically for scholarship consideration.

Next, find the state deadlines for the FAFSA.

Each state will have a priority deadline for their public universities. Public universities typically have extended deadlines that can be as late as June prior to the start of fall term, which usually begins in August.

Finally, take note of the federal FAFSA deadline.

It is usually the last day of June before the fall term begins. There’s also a deadline to submit corrections or updates. This usually falls in early September. Make sure you rely on the official FAFSA website for specific deadlines.

What Do I Need To Complete The FAFSA for 2024-2025?

You need 7 things to complete your FAFSA

- Your FSA ID

You’ll need your social security number plus your email and/or mobile phone number.

Create your FSA ID at studentaid.gov.

Students and parents should create their own FSA ID. You’ll use it to electronically sign the FAFSA. Just like everyone has their own unique handwritten signature, everyone needs a unique electronic signature, their FSA ID.

(DO NOT create an FSA ID for anyone else. Parents, you need to make sure your student does this on their own.)

Create your FSA ID a few days before you plan to submit the FAFSA, just in case there’s a delay. Remember, we’re all about eliminating unnecessary stress, like unforeseen delays you can’t control.

- Your social security number

- Your driver’s license number

- Your 2021 federal tax return

The fastest, easiest and most secure way to add tax information to your FAFSA is to use the IRS Data Retrieval Tool. Find out if you’re eligible to use the tool.

For the 2024-2025 FAFSA, you must use your 2022 tax information. We know this can be frustrating for many families whose financial situation changed in 2023.

Fortunately, you can submit documentation directly to financial aid offices and request an updated financial aid offer based on your additional information.

- Documentation of your nontaxable income

- Documentation of your assets

- List of up to 10 colleges and universities

The FAFSA allows you to select up to 10 institutions under consideration. You are not locked in to applying or enrolling at any of these schools. This simply means the selected institutions will receive a report from the U.S. Department of Education that you’ve chosen them as an option on the FAFSA.

You have the option to add schools later in the process.

What Types Of Financial Aid Are Available?

There are 4 basic types of aid. This is true regardless of the type of college or university you plan to attend. The main difference between 4 types is whether or not you need to repay the aid you received. Sometimes you do, sometimes you don’t. I’ll explain.

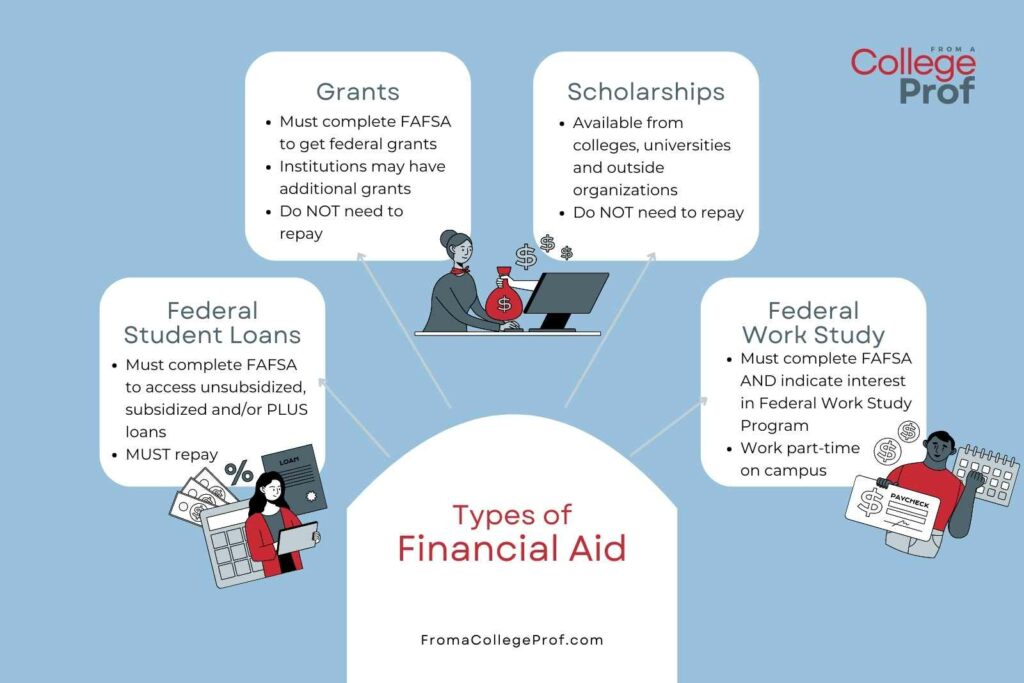

1. Federal Student Loans

All Federal Student Loans must be repaid.

The first type of financial aid most of us are familiar with (for better or worse) is Federal Student Loans. There are 3 kinds of federal student loans: unsubsidized loans, subsidized loans and PLUS loans.

The ONLY WAY to access a federal student loan is by completing your FAFSA (see above).

Unsubsidized loans: Everyone who completes the FAFSA will have the option for an unsubsidized loan. It is not dependent on financial need (as determined by the FAFSA). Interest accrues on unsubsidized loans right away.

Subsidized loans: Only some students who complete the FAFSA will qualify for the option of subsidized loans. The federal government takes care of the interest while you’re in school. You’re responsible for interest that starts accruing 6 months after you leave school.

PLUS loans: These loans are another option for everyone who completes the FAFSA. They’re available to parents as financial assistance for their college student to cover the cost of attendance (COA).

Private loans are also available from banks and credit unions. We don’t recommend these because they’re a lot more expensive.

2. Grants

Grants do NOT need to be repaid.

The ONLY WAY to access federal grants is by completing your FAFSA (see above).

The most well-known grant is the Pell Grant, part of Federal Student Aid. The Pell Grant is based on your Estimated Family Contribution (EFC).

Colleges and universities may award additional grants for extended need.

3. Scholarships

Scholarships do NOT need to be repaid.

You may receive a scholarship from the college where you’re applying. Institutions offer a wide range of scholarships for merit (academics), talent (athletics, music, etc.), or leadership.

You may receive a scholarship from an outside source. Many local and national non-profit organizations award scholarships to aspiring college students.

4. Federal Work Study

The ONLY WAY to access work study is by completing your FAFSA (see above) AND indicating your interest in the Federal Work Study Program.

If you qualify, you can work part-time on campus in various departments. The library, student union, recreation center, dining hall and tutoring center are common examples of where you might find a federal work-study job.

FAQ About the FAFSA

On college and university websites and the Federal Student Aid website.

Even higher-income students should complete the FAFSA. If you don’t, you may miss out on institutional aid that you would be eligible for. Most schools offer institutional aid only if a FAFSA is on file.

You also need the FAFSA for any federal loans that aren’t need-based aid, like unsubsidized federal student loans that we discussed earlier.

If you have been admitted to a school and they don’t have your FAFSA application on file, they will reach out to encourage you to complete it.

No. You must be a U.S. citizen to receive federal aid. Undocumented students can receive institutional aid and scholarships, but they aren’t eligible for federal financial aid.

Yes. The citizenship status of your parents does not matter on the FAFSA. If you are a citizen, you can still use their financial information and be eligible for federal financial aid.

Ask a financial aid professional. You should be able to find help from your state’s Association of Financial Aid Administrators. For example, the Ohio organization (OASFAA) has an outreach committee and online resources to help families.